Seamless interactions powered by technology

In sophisticated production processes, with complex logistic chains such as automotive, advanced engineering and logistic hubs, goods, machines and people interact seamlessly. These seamless interactions require governance of tightly designed processes, systems and protocols and enable customers to order a non-standard baby-pink car and have it delivered the same day as the standard black version, at the same price. Offering a ‘special’ service at a standard price and terms, makes for a seamless customer experience.

Internet of… seamless travel

Imagine a seamless travel experience from the moment you decide to go on vacation. Everything is taken care of; your heating will be switched off, your luggage picked up from home and delivered at your destination, your family picked up and delivered close to the gate and security checks happen as you walk onto the plane. The underlying business opportunities are plenty, from the one that provides the initial booking to the different service providers that provide their part of the service such as the transport company, hotel and restaurants at the destination. No one actor can deliver everything, but many can win by sharing and using the flow of dynamic data as people travel.

Healthcare is moving from in-hospital diagnosis and care to hybrid services where education, prevention, diagnosis and treatment can happen at different times and are provided by different parties. The blurring of different responsibilities means that someone with a medical risk should be monitored and made aware of the different things they can do to prevent escalations. Behind the scenes doctors, specialists, insurance providers, family and social networks can all collaborate without a heavy burden on the system. The monitoring of physical, mental and social indicators, in combination with input of experts, means a client does not have to become a patient.

Internet of… personalised insurance

Even in traditional sectors like insurance, connected “things” mean that people can cover their risks in completely new ways. A basic car insurance can be personalised around who drives, where, when and how long. Complex actuary models that determine price and structure of insurance products can be replaced by dynamic risk assessments where customers pay per use. Segments such as young drivers can now be served by shifting the risk assessment based on age and location to behaviour. Real time risk assessments open the door not only to completely new services, but also to new actors to offer coverage independent of traditional insurance companies.

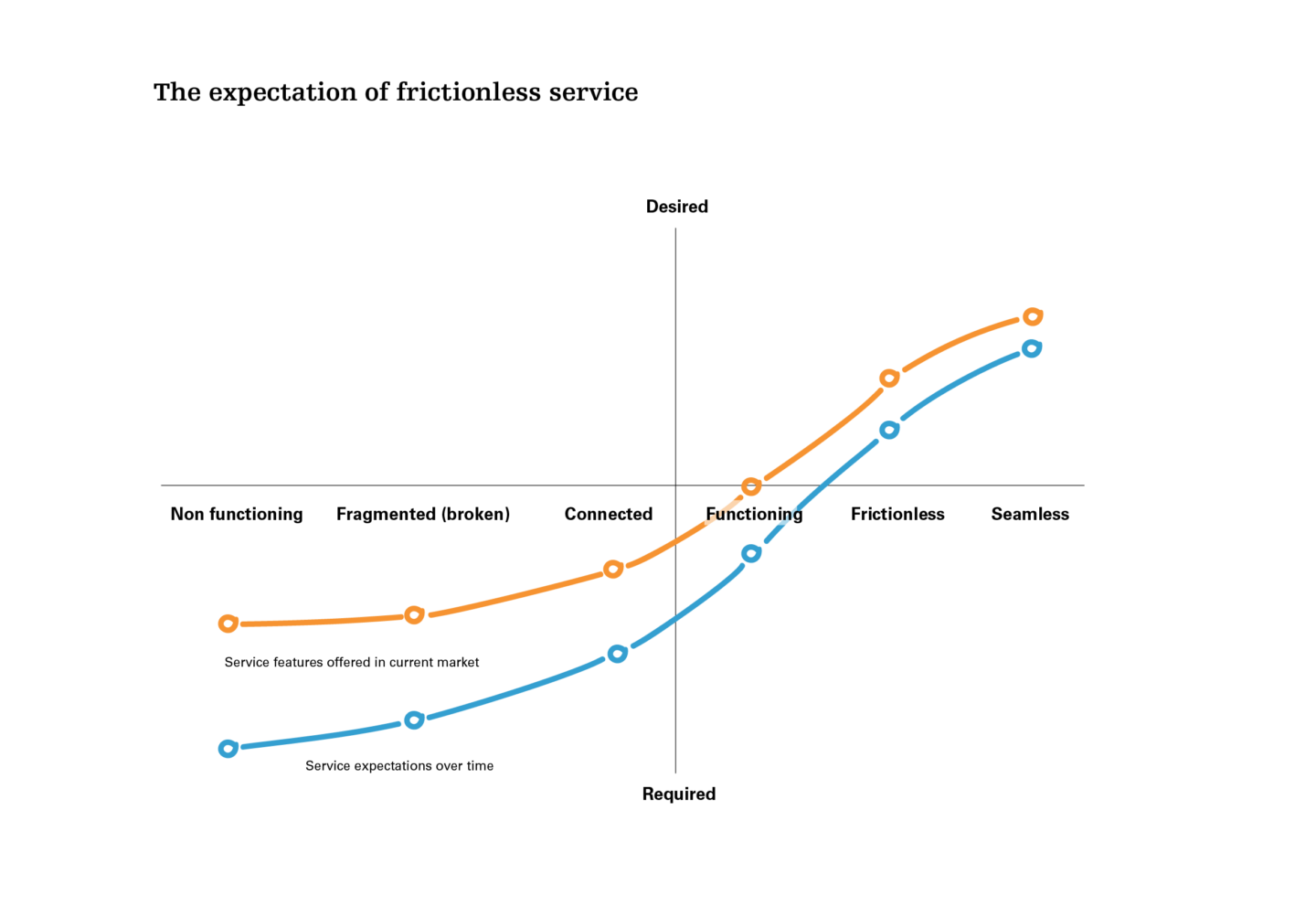

From broken experiences to frictionless services

Frictionless experiences mentioned in this article are possible today but require multiple service providers and actors to collaborate and share information. Unlike the Just-In-Time logistic chain, there are no tight rules or agreements in place to govern the interplay of actors. There are fundamental business opportunities around new and innovative services to:

Create seamless experiences for customers based on connected and combined services

Create and offer new services that complement and/or replace existing ‘broken “ services

Orchestrate the combination of data and monitors, and sensors in a technical platform that can be used for creating and supporting new services.